Bucks County Property Appraiser

Bucks County, Pennsylvania Board of Assessment

Bucks County Board of Assessment Appeals Board of Assessment Appeals Office County Administration Building 55 E. Court Street Doylestown, PA 18901 Phone: 215-348-6219 Fax: 215-348-7823 Email: [email protected] Robyn Trunell, Chair Victor Corsino, Vice Chair Christina Gerhart, Board Member The filing deadline for Homestead/Farmstead Exclusion for the tax year beginning July 1, 2026 is March 1, 2026.

https://www.buckscountyboa.org/

Commissioners Approve 2026 Operating Budget

The Bucks County Board of Commissioners today approved the County's 2026 operating budget. The Board enacted a $517 million plan to fund the ...

https://www.buckscounty.gov/CivicAlerts.aspx?AID=1472Bucks County raises taxes 8% to fill $16.4 million 2026 ...

Property taxes are going up about 8% in 2026 to fill a $16.4 million deficit in Bucks County's $516 million budget. The Bucks County ...

https://www.phillyburbs.com/story/news/local/2025/12/17/bucks-county-commissioners-approve-tax-hike-for-deficit-in-2026-budget/87812456007/County tax roundup: Chesco stays level as Bucks, Delco and Montco rates rise - SRA: Suburban Realtors Alliance

County property taxes in Bucks, Delaware and Montgomery counties will increase in 2026, but Chester County taxes will stay level. Property tax rates are measured in millage, with one mill being worth $1 for every $1,000 of assessed property value. - Bucks County commissioners voted 2-1 to adopt a roughly $517 million budget for 2026 that includes a 2.2-mill property tax increase.

https://www.suburbanrealtorsalliance.com/blog/2026/01/02/local/county-tax-roundup-chesco-stays-level-as-bucks-delco-and-montco-rates-rise/

Board of Supervisors Adopts 2026 Township Budget Middletown Township Bucks County PA

Board of Supervisors Adopts 2026 Township Budget At its December 17 meeting, the Middletown Township Board of Supervisors voted to adopt the 2026 Township Budget, following several months of public meetings, discussions, and community engagement. The adopted budget includes modest reductions to the originally proposed real estate tax increase while maintaining critical investments in Township services and infrastructure.

https://www.middletownbucks.org/Newsroom/News/2025/December/Board-of-Supervisors-Adopts-2026-Township-Budget

WHYY - Bucks County commissioners voted 2-1 Wednesday to... Facebook

Bucks County commissioners voted 2-1 Wednesday to adopt a 2026 budget that includes a 2.2-mil property tax increase to close an operational budget deficit of more than $16 million.

https://www.facebook.com/whyypublicmedia/posts/bucks-county-commissioners-voted-2-1-wednesday-to-adopt-a-2026-budget-that-inclu/1350301030441961/

Bucks County commissioners approve 8% property tax ...

Let us know! Bucks County commissioners voted 2-1 Wednesday to adopt a 2026 budget that includes a 2.2-mil property tax increase to close an ...

https://whyy.org/articles/bucks-county-commissioners-property-tax-increase/Board of Assessment Appeals Bucks County, PA

Board of Assessment Appeals About the Board The primary function of the board, which is comprised of three members, is to determine the current market value of all properties in the county and calculate the appropriate assessment. The board, whose administrative duties are strictly governed under statutes established by the General Assembly for the Commonwealth of Pennsylvania, also maintains policies, management operations, and supervises ass...

https://www.buckscounty.gov/438/Board-of-Assessment-Appeals

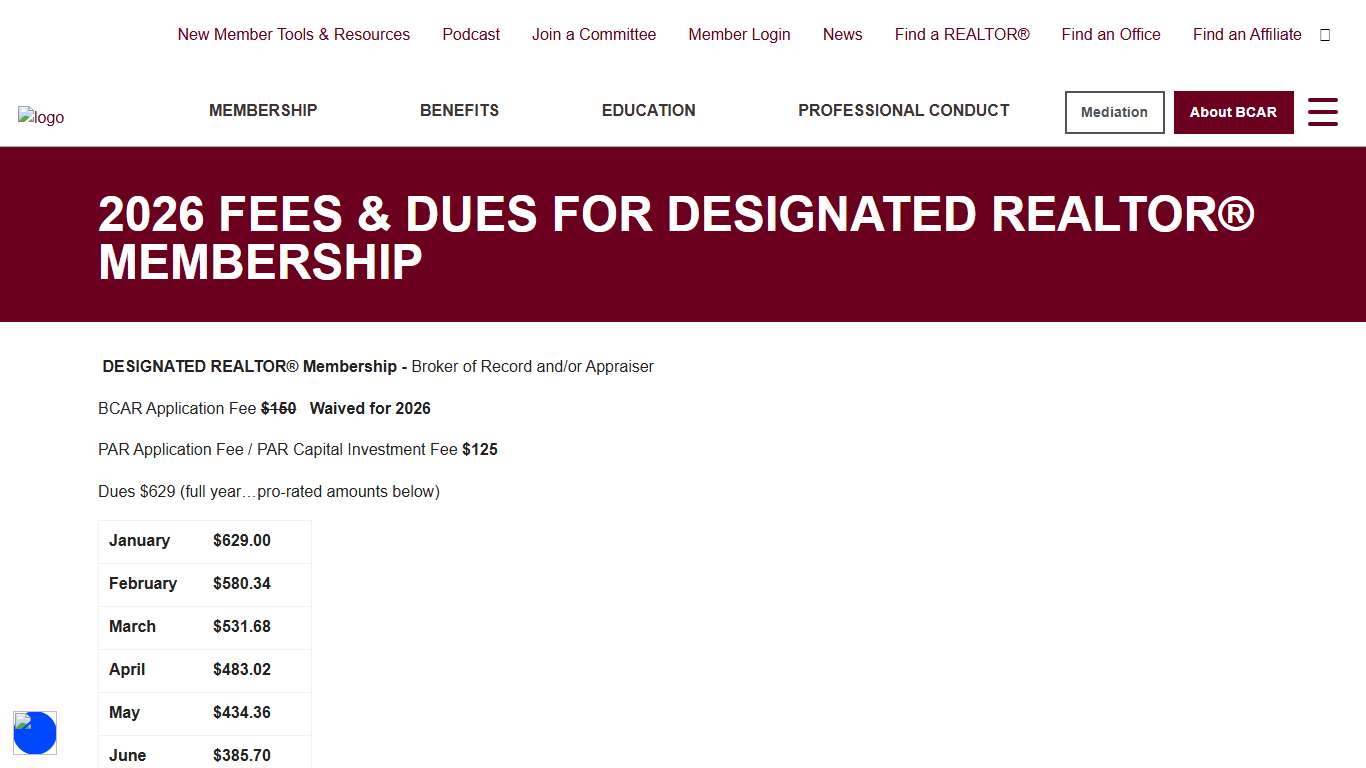

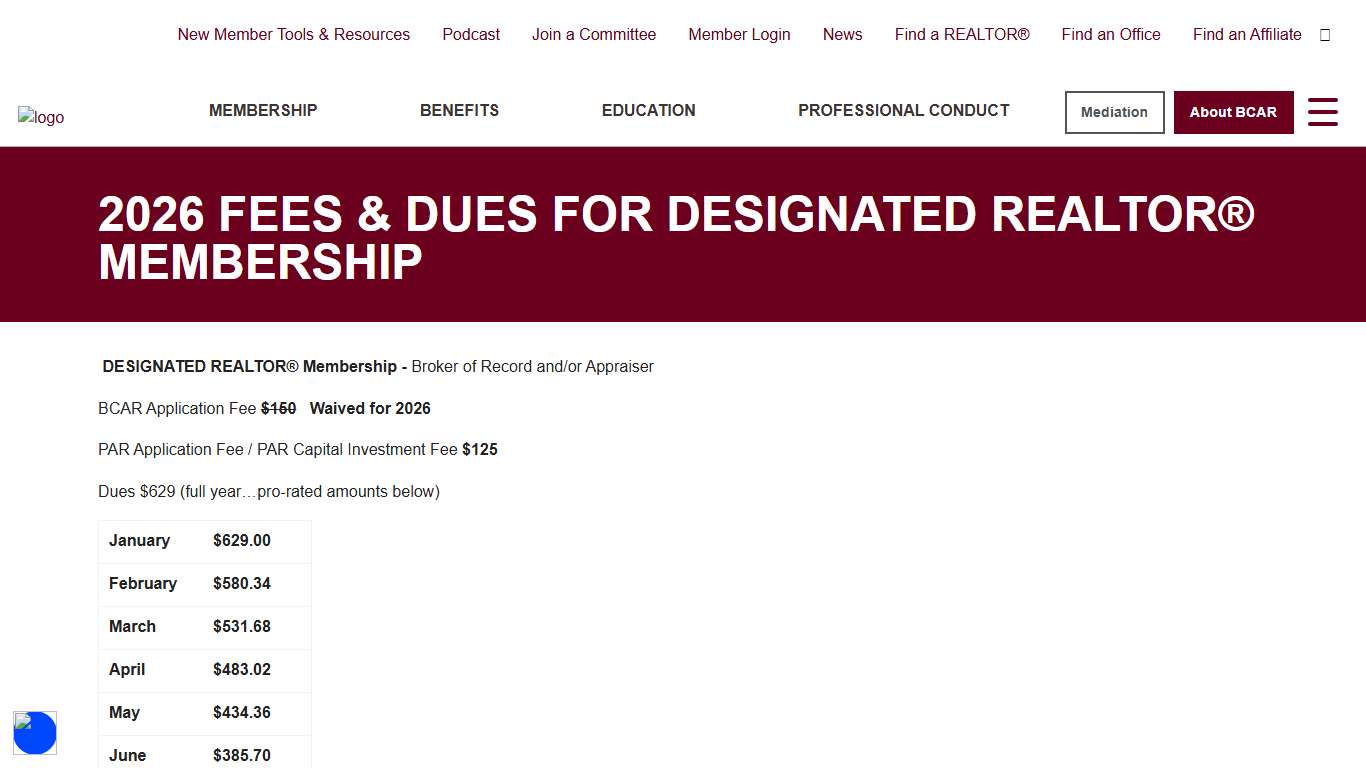

2026 FEES & DUES FOR DESIGNATED REALTOR® MEMBERSHIP - Bucks County Association of Realtors

DESIGNATED REALTOR® Membership - Broker of Record and/or Appraiser BCAR Application Fee $150 Waived for 2026 PAR Application Fee / PAR Capital Investment Fee $125 Dues $629 (full year…pro-rated amounts below) Membership is given on a provisional basis until all membership requirements are completed: Application fee, PAR Capital Investment Fee, and dues are paid; the applicant is approved for membership by the Board of Directors, and the applic...

https://www.bucksrealtor.com/join/2026-fees-dues-for-designated-realtor-membership/

The Bucks County Board of Commissioners has approved the County’s 2026 operating budget. The $517 million plan will fund departments and agencies serving county residents, as well as the County’s courts and nine elected row offices. Read more ➡️ Link in bio.

https://www.instagram.com/p/DSaXd7Oj-Wb/

Bucks County Officials Consider Tax Increase For 2026 - New Hope Free Press

Bucks County officials are working to deal with a $16.4 million projected deficit in the preliminary 2026 budget. The Bucks County Commissioner – two Democrats and a Republican – could consider a property tax increase to balance the spending plan. Bucks County Chief Financial Officer Jeannette Weaver went over the $516 million operating budget at a recent public hearing.

https://www.newhopefreepress.com/2025/12/15/bucks-county-officials-consider-tax-increase-for-2026/

Bucks proposes 3.2% expense increase in $516M 2026 budget - Central Bucks News

The County of Bucks today released its preliminary 2026 operating budget, a $516 million proposal to fund the County government in the new year. With provisions for all County departments, including row offices and the courts system, the budget as proposed represents a 3.2% increase in expenditures over the previous year.

https://centralbucksnews.com/news/2025/dec/01/bucks-proposes-32-tax-increase-in-516m-2026-budget/

2026 FEES & DUES FOR DESIGNATED REALTOR® MEMBERSHIP - Bucks County Association of Realtors

DESIGNATED REALTOR® Membership - Broker of Record and/or Appraiser BCAR Application Fee $150 Waived for 2026 PAR Application Fee / PAR Capital Investment Fee $125 Dues $629 (full year…pro-rated amounts below) Membership is given on a provisional basis until all membership requirements are completed: Application fee, PAR Capital Investment Fee, and dues are paid; the applicant is approved for membership by the Board of Directors, and the applic...

https://www.bucksrealtor.com/join/2026-fees-dues-for-designated-realtor-membership/

Bucks County Approves 2026 Budget with 8 Percent Property Tax Increase: Implications for Local Homeowners

Bucks County Approves 2026 Budget with 8 Percent Property Tax Increase: Implications for Local Homeowners In a decision that has sparked considerable discussion among residents, the Bucks County Board of Commissioners voted on December 17, 2025, to approve a $517 million operating budget for 2026, incorporating an 8 percent increase in property taxes.

https://www.exploreatexprealty.com/blog/bucks-county-approves-2026-budget-8-percent-property-tax-increase-implications-local-homeowners/

Bucks County Real Estate Taxes Going Up 8% in 2026 Doylestown, PA News TAPinto TAPinto

DOYLESTOWN, PA—Bucks County taxes are going up 8% in 2026. The Bucks County Commissioners approved a $517 million budget for next year that included a $16.4 million deficit. To close the gap, the commissioners increased the 2026 rate by 2.2 mills, from 27.45 mills in 2025 to 29.65 mills in 2026.

https://www.tapinto.net/towns/doylestown/sections/government/articles/bucks-county-real-estate-taxes-going-up-8-in-2026

Bucks County Property Tax Inquiry

Bucks County Property Tax Inquiry Disclaimer If you would like to pay a delinquent tax bill to avoid a Tax Sale, please call the Tax Claim Bureau at 215-348-6274 during regular business hours for any questions about making payments. Monday - Friday, 8:15 AM - 4:15 PM Closed on Holidays...

https://buckspa.devnetwedge.com/